India’s credit card economy, a symbol of growing consumer confidence and digital empowerment, is showing some signs of strain. Credit card delinquencies in the 91–360 days overdue category have soared by a staggering 44.34 per cent over the past year, reaching Rs 33,886.5 crore as of March 2025, up from Rs 23,475.6 crore in March 2024, according to the latest data from CRIF High Mark.

This sharp rise highlights a growing vulnerability among borrowers, particularly in the 91–360 days category, a segment that banking regulations categorise as non-performing assets (NPAs) in the case of bank loans. Effectively, credit card holders have defaulted on nearly Rs 34,000 crore of debt that has remained unpaid for over 91 days.

The breakdown of distress

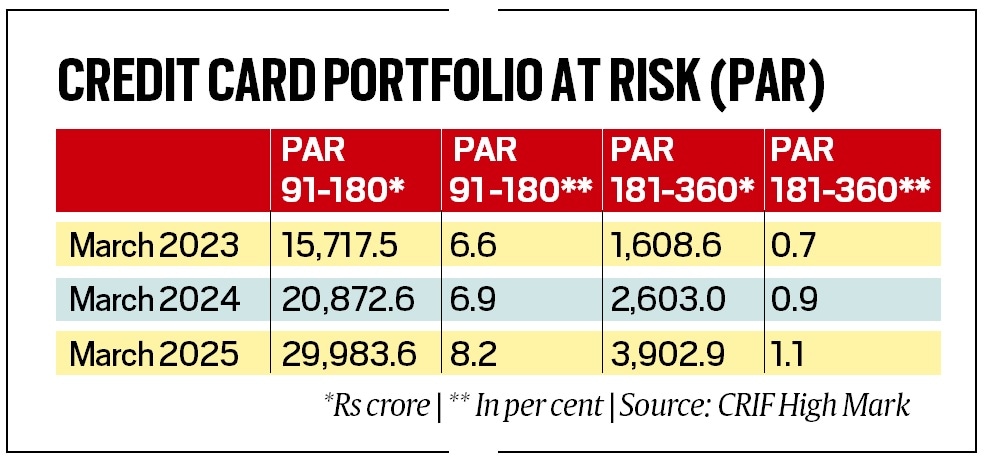

A closer look at the numbers reveals a disturbing trend. In the 91–180 days overdue segment alone, the delinquent amount jumped to Rs 29,983.6 crore, compared to Rs 20,872.6 crore a year earlier, and has almost doubled from the March 2023 level, data prepared by CRIF High Mark for The Indian Express says. This reflects not just a growing reliance on credit but a mounting inability — or unwillingness — to repay on time.

CRIF High Mark, a credit bureau registered with the Reserve Bank of India (RBI), noted a steady uptick in the percentage of portfolio at risk (PAR), which tracks overdue payments. In March 2025, PAR in the 91–180 day bucket reached 8.2 per cent, rising from 6.9 per cent in March 2024 and 6.6 per cent in March 2023 — a consistent three-year climb. For loans overdue 181–360 days, the PAR rose to 1.1 per cent, up from 0.9 per cent in 2024 and 0.7 per cent in 2023.

These trends signal both short-term and long-term stress in the unsecured credit market, especially as consumers lean heavily on plastic for everyday and discretionary spending. Credit card outstanding was Rs 2.90 lakh crore as of May 2025 as against Rs 2.67 lakh crore in May 2024, according to the RBI.

A credit-driven consumption boom

The increase in delinquencies is set against the backdrop of an explosive rise in credit card usage across the country. The value of credit card transactions reached Rs 21.09 lakh crore by March 2025, surging from Rs 18.31 lakh crore the previous year — a nearly 15 per cent jump.

This boom mirrors India’s post-pandemic economic recovery and reflects rising consumer confidence. Credit card spending in May 2025 alone was Rs 1.89 lakh crore, up dramatically from Rs 64,737 crore in January 2021.

Story continues below this ad

Likewise, the number of credit cards in circulation has ballooned. As of May 2025, 11.11 crore credit cards were active in India, compared to 10.33 crore in May 2024 and just 6.10 crore in January 2021, according to RBI data.

People tend to borrow and spend more when they’re optimistic about their financial future, but may also rely on credit cards to maintain their standard of living when wages stagnate or prices rise, said an investment analyst.

Rewards, offers — and debt traps

What’s fuelling this sharp uptick in usage? Banks and fintech firms have aggressively promoted credit card adoption with attractive incentives: cashback rewards, travel perks, interest-free EMIs, and airport lounge access. For many consumers, especially in urban and upwardly mobile segments, credit cards have become synonymous with convenience and lifestyle.

But the ease of swiping has come with a hidden cost. Credit card debt is among the most expensive forms of borrowing in India. Banks typically charge between 42 per cent and 46 per cent annual interest on unpaid balances beyond the interest-free period.

Story continues below this ad

“Customers often get lured by flashy offers and rewards. But if they don’t repay on time, they end up paying exorbitant interest,” said a senior bank official. A few missed payments can quickly spiral into a debt trap.”

Why it matters

The sharp increase in delinquencies poses a risk not just to individual borrowers but also to the broader financial system. Credit card loans are unsecured, meaning they are not backed by collateral. Rising defaults can affect banks’ balance sheets and prompt tighter lending norms, thereby slowing credit growth, a key driver of consumption in India. The RBI indeed hiked the risk weight on credit card outstanding in 2023.

Moreover, defaults affect credit scores. For individuals who fall behind on payments, the financial impact is immediate and long-lasting. A damaged credit score or history can limit future access to loans, credit cards, or even rental agreements and job opportunities in some sectors.

While credit cards offer flexibility and financial freedom, their misuse or overuse can have serious consequences. As more Indians embrace digital credit, the focus must now shift from spending to managing debt responsibly, experts say.

Story continues below this ad

Banks, regulators and fintechs need to step up educational initiatives around interest rates, billing cycles, and repayment discipline. For consumers, the message is clear: credit cards are a tool — not free money. Use them wisely, or risk paying a heavy price.